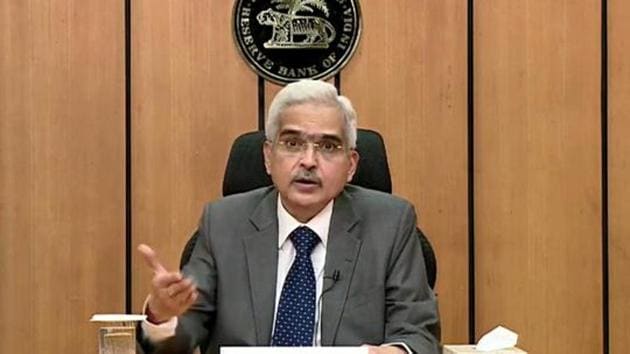

RBI governor to announce key policy decision at 12 noon: All you need to know

Experts are of the view that the MPC is likely to keep the interest rates unchanged and that a cut would come as a surprise.

Reserve Bank of India (RBI) governor Shaktikanta Das is likely to make key policy announcement on Thursday during the bi-monthly monetary policy address. It is to be seen whether Das will announce interest rates cut to support the economy in the face of inflation.

RBI’s Monetary Policy Committee (MPC) is expected to keep its policy stance accommodative when it announces the decisions of the panel on Thursday. Experts are of the view that the MPC is likely to keep the rates unchanged and that a cut would come as a surprise.

Kaushik Das, chief India economist at Deutsche Bank AG in Mumbai told Bloomberg that the RBI governor has recently turned his attention toward the fragile financial sector amid forecasts for a sharp rise in bad loans. Those concerns could outweigh inflation risks and prompt a rate cut.

A survey conducted by HT’s business publication Mint showed that six out of 10 bankers expect the RBI to keep the repo rate on hold at 4%, while the rest expect a 25 basis point cut.

A Bloomberg poll of 42 economists showed that economists were divided with 21 expecting a 25 basis point cut and 20 predicting a pause.

The RBI targets to keep inflation in a range of 2%-6%, but consumer-price growth has exceeded the upper end of that band for most of the past two quarters. According to a Bloomberg report, the MPC may revise its forecasts higher.

Besides this, investors are looking for assurances that liquidity will be in surplus and that the RBI continues its secondary market bond purchases and yield curve control measures to absorb a record government borrowing program.

(With inputs from Bloomberg)

Stay informed on Business News, TCS Q4 Results Live along with Gold Rates Today, India News and other related updates on Hindustan Times Website and APPs