For elderly, pension is the answer

By 2050, every fifth Indian will be above the age of 60, according to a 2017 joint report brought out by the Pension Fund Regulatory Development Authority (PFRDA) and CRISIL.

Though India is often characterised as a young country, it’s also a country of old people.

By 2050, every fifth Indian will be above the age of 60, according to a 2017 joint report brought out by the Pension Fund Regulatory Development Authority (PFRDA) and CRISIL. Nearly five million Indians join the ranks of the elderly every year. An ageing population and changing family structures create some of the most important policy challenges. The question really is: can India ensure sustainable financial protection and dignity for its 104 million elderly by the time this demographic transition is complete?

The task is difficult, but not impossible. Retirement support through pensions is crucial to any package of elderly support. At present, only 12% of Indians are covered by a formal pension scheme (those that are supported by employer contributions such as Provident Fund), as per government figures. The problem is further compounded by rising life expectancy: nearly two decades at age 60 today. Evidence from sources suggests that the lifetime savings of those between 50 and 60 years today will be sufficient to support them for barely two years after they leave the workforce. This means that most of India’s elderly will need to rely on a combination of physical assets such as land and informal family-based arrangements for support. A vast majority faces the grim prospect of over 20 years of extreme poverty in their old age.

With the rise of the gig-economy and other types of unorganized work, a vast majority of Indians hold jobs that offer no social security benefits and pay irregularly. Thus, providing a core basket of social protection benefits to all Indians becomes critical for strengthening growth and inclusion. Pensions form a key ingredient of this basket, especially since most households find it difficult to save for their future.

Beyond formal pension, there are two tools to support the elderly when earnings cease. First, contributory pension programmes, such as the National Pension Scheme (NPS), the Atal Pension Yojana (APY) and the more recently announced Pradhan Mantri Shram-Yogi Maandhan Yojana (PMSYMY 2019). However, even these will work only for a small number— those who are still young and also have the financial wherewithal to save.

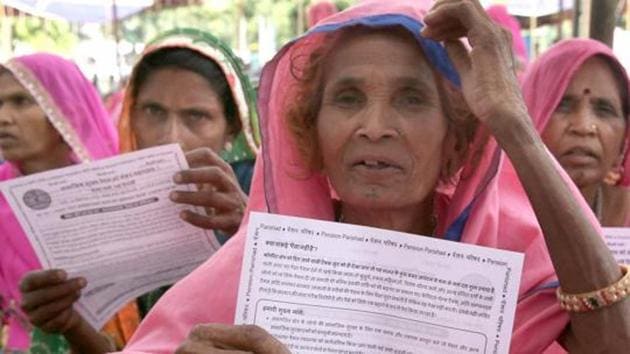

For citizens with low or irregular incomes, and equally for those who are already old or are nearing retirement, governments often use a second tool — tax-funded unconditional cash transfers, also known as social pensions. Evidence from countries such as China shows how rural social pensions tend to free up some of the support provided by children while also increasing healthcare consumption of the elderly. In India, social pensions have emerged as a key tool to protect the elderly poor — serving nearly 24 million destitute old.

Contributory pension schemes have made important progress recently. The number of subscribers for NPS-Lite, which like APY, targets weaker economic segments and unorganized workers, had increased to nearly 15.7 million as of July 2018, as per the PFRDA. Although these are impressive numbers by global standards, in the Indian context, it is modest, covering barely 4% of the country’s 391.4 million unorganized workforce.

World Bank survey across Delhi and Odisha suggests that low and irregular income, challenges in identification of target group, low retirement literacy and insufficient awareness of the NPS and APY are some of the primary reasons for both, low uptake and poor persistency, of pension schemes. These challenges will plague new ‘mega pension’ schemes such as PMSYMY as well.

If low uptake of contributory pensions continues, most of India’s young informal sector workers will inevitably fall back on tax-funded social pensions when they are old. This will prove to be a fiscal burden on the state in the long run. To prevent this from happening, central and state governments will need a two-pronged approach.

First, the currently young workforce must be encouraged to save. The government should invest in simple and affordable implementation systems that use new fintech tools so that individuals can easily join such schemes. Such mass mobilization will help generate a large pool of stable, long-term household savings. PFRDA should simultaneously test auto-enrollment options. For example, auto-enrolment of the nearly 400 million Jan Dhan Bank account-holders who do not yet have a pension account can yield rapid, positive results. The growth of digital payments in India — where retirement savings can be transferred in a transparent and flexible manner at a tiny transaction cost — can enable a citizen-friendly and sustainable mode of pension financing which does not rely on payroll-taxes.

Second, for those who are already old or do not have the financial capacity to save, the value and efficacy of tax-funded old age pensions must be enhanced. While many states have opted for near-universal eligibility criteria for social pensions, our representative sample surveys of 9,500 people in Haryana, Uttar Pradesh, Bihar, Odisha and Delhi’s slums between 2013 and 2015 highlighted the challenges in translating policy into practice due to cumbersome enrolment processes.

Scaling up pension coverage and ensuring meaningful retirement is vital. While initiatives such as PMSYMY are very welcome, making India a pensioned society requires more than new schemes. In fact, multiple pension schemes need to be better coordinated to ensure universal coverage. It’s critical to strengthen benefit levels of tax-financed social pensions for those who cannot save, in combination with investment in building citizen-friendly systems to roll out contributory pension schemes for young adults. The lives and dignity of an entire generation of India’s elderly is at stake.

Get Current Updates on India News, Lok Sabha Election 2024 live, Infosys Q4 Results Live, Elections 2024, Election 2024 Date along with Latest News and Top Headlines from India and around the world.