Number theory: Green energy overturns investment gap, but needs to cover more lost ground

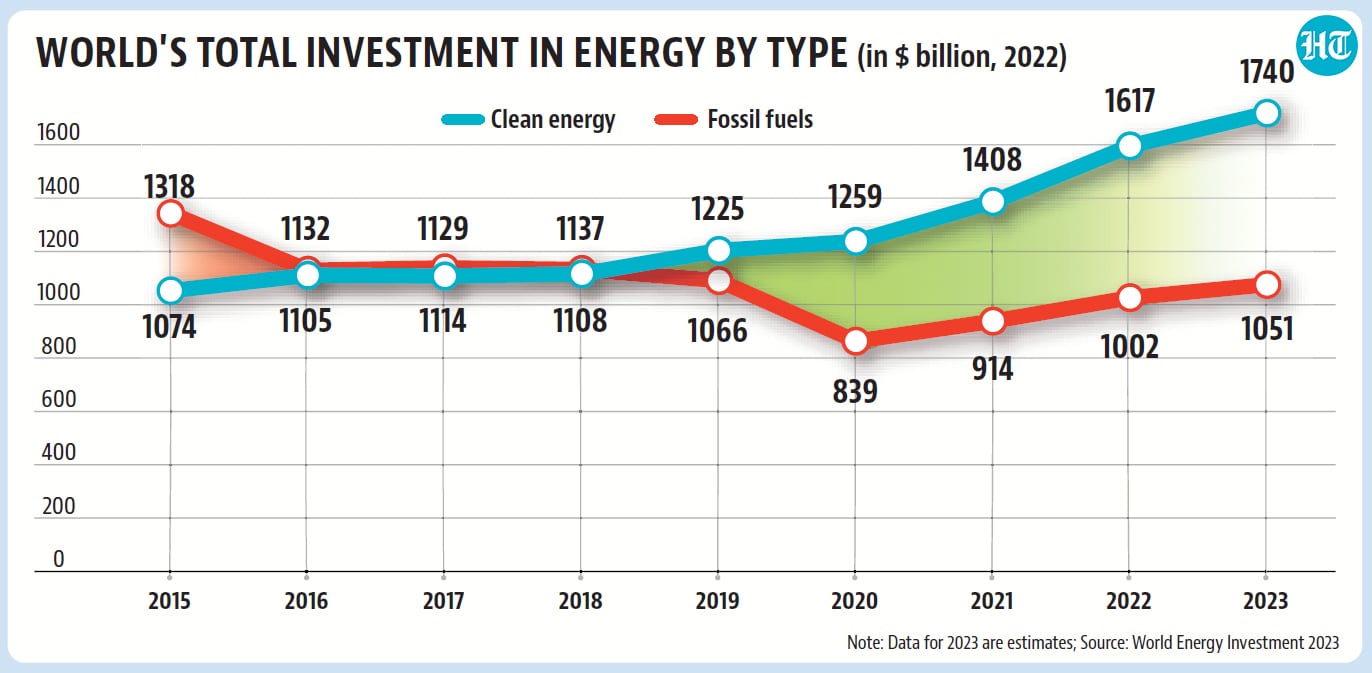

The world is expected to invest $1.74 trillion (2022 prices) in clean energy in 2023, 1.7 times the money which will go in fossil fuel investments.

Investment in clean energy has been more than the money that has gone to the fossil fuel industry since 2016, and the gap was the highest in 2022. While this is good news on the climate crisis front, the current pace and geographical spread of investment in clean energy is not enough to deal with the challenge at hand. These findings are based on a reading of the World Energy Investment Report released by the International Energy Agency on May 25. Here are five charts which explain the salient points in the report.

Clean energy investment will be 1.7 times that in fossil fuels in 2023

First, the good news. The headline numbers of the report show that the world has at least understood that it needs to invest more in clean energy. The world is expected to invest $1.74 trillion (2022 prices) in clean energy in 2023, 1.7 times the money which will go in fossil fuel investments. This ratio has been increasing every year from 2017 onward and was 1.61 last year. That this represents a major change can be understood from the fact that in 2015, only eight years ago, we were investing more in fossil fuels than in clean energy.

Also Read: A strategy to win energy independence by 2047

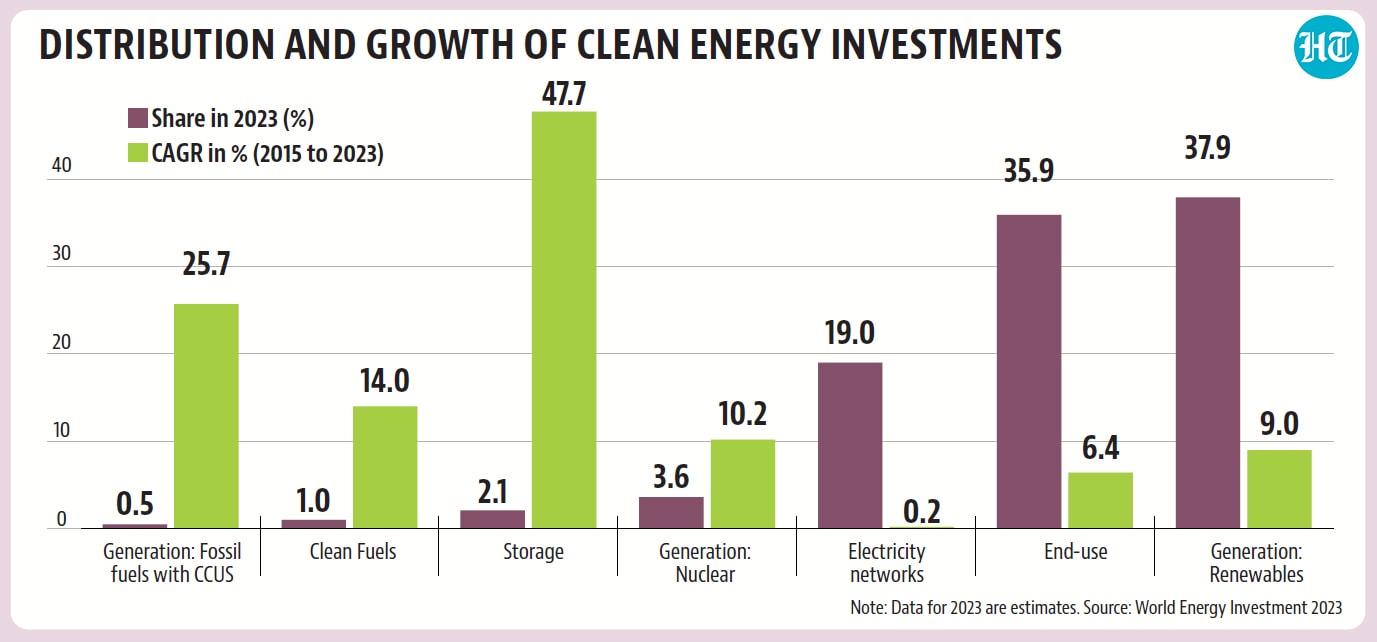

Investment in clean energy is not just about energy production though

To be sure, the investment figures for clean energy shown above do not quantify just investment in generating energy from renewable sources. They also show investment made towards decreasing energy consumption by boosting efficiency or promoting direct use of renewables in activities such as heating. A break-up of the investment pattern in 2023 shows that over a third of the investment is actually going towards this very aspect of cleaning up the energy sector, classified as “end-use” in the report. A similar share of clean energy investment will go to generation from renewables and 19% to setting up electricity networks. To be sure, investments in what are so far small components of clean energy investment are rising fast. Investment in storage, for example, has grown at a CAGR (compound annual growth rate) of 47.7% since 2015, faster than any other component: from $2 billion (in 2022 prices) in 2015 to $37 billion in 2023. Storing energy at lower prices is one of the central challenges in making things such as solar energy economically viable.

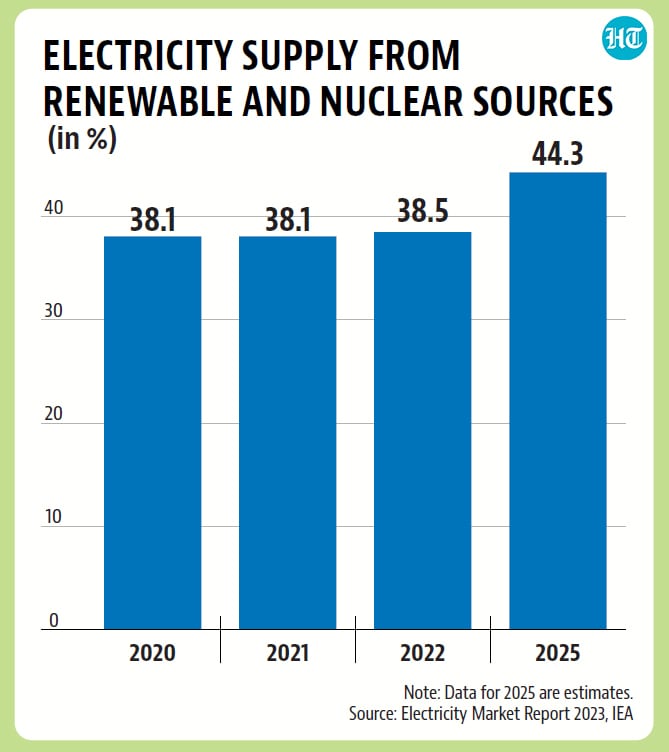

More investment in clean energy does not mean the world is consuming more clean energy today

To be sure, investments are more of an indicator of what to expect in the future than the energy mix we are consuming right now. For example, 61.7% of the investment in energy in 2022 went to clean energy. However, only 38.5% of electricity was generated from renewable and nuclear sources in the year, according to IEA’s Electricity Market Report of 2023 earlier this year. This share will increase only up to 44% by 2025. This means that investment in clean energy will have to increase much more for a quick turnaround to actual generation. The May 25 report says that investment in clean energy is still less than half of what is required for net zero emissions by 2050. Why is the investment slower than required so far? The report gives a good idea why this is the case. “For the moment, sustainable finance instruments remain concentrated in advanced economies, accounting for nearly 80% of sustainable debt issuance in 2022,” the report says.

Read: ‘India can have 3.5 million jobs in the renewable energy sector by 2030’

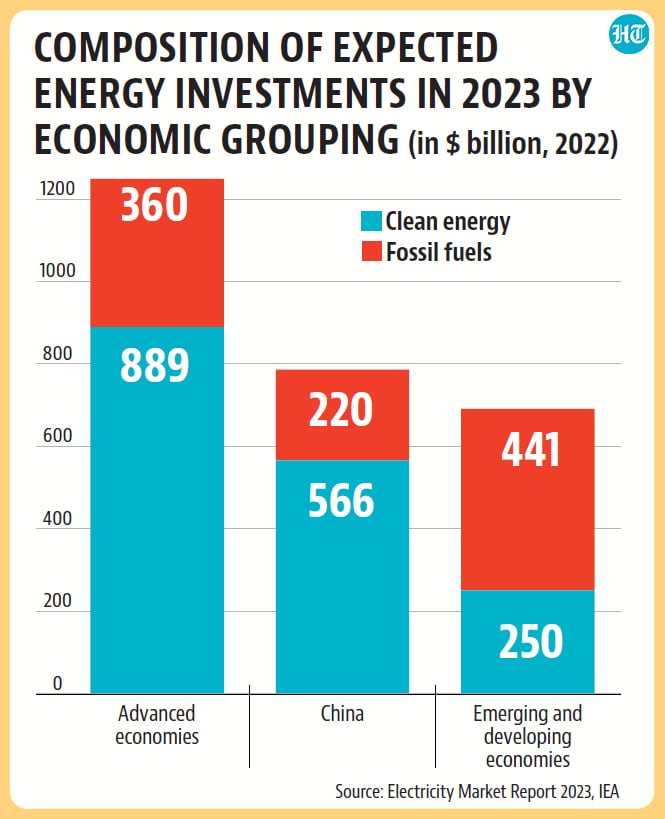

Who is investing in clean energy?

The IEA report also gives data on investment by three economic groups: advanced economies (38 OECD countries, plus Bulgaria, Croatia, Malta and Romania), China (including Hong Kong), and all remaining countries. The break-up of investment in clean energy by these groups shows that advanced economies will contribute slightly more than half (51%) to it, China will invest 33%, and the other countries will make up the remaining 16%. These numbers were 50%, 27%, and 23% in 2015, the first year for which the report gives data. It suggests that clean energy investment has grown in China faster than in the other two groups in the period for which the report gives data. The CAGR of clean energy investment since 2015 is 6.6% in advanced economies, 8.9% for China, and 0.7% for emerging markets and developing economies.

Get Current Updates on India News, Ram Navami Live Updates , Lok Sabha Election 2024 live, Elections 2024, Election 2024 Date along with Latest News and Top Headlines from India and around the world.

Continue reading with HT Premium Subscription