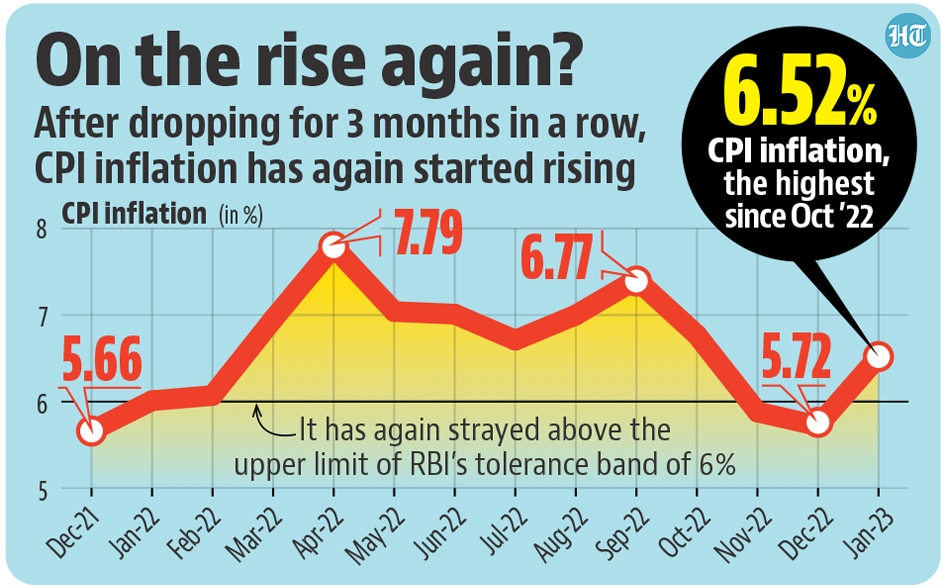

Retail inflation shoots up to 3-month high of 6.5% in Jan as food prices bite

High cereal and protein prices pushed India’s retail inflation beyond RBI’s tolerance zone once again in January , with the headline Consumer Price Index (CPI) print coming in at 6

High cereal and protein prices pushed India’s retail inflation beyond RBI’s tolerance zone once again in January , with the headline Consumer Price Index (CPI) print coming in at 6.5%, significantly higher than the 6% value projected by a Bloomberg poll of economists.

The latest data raises questions on whether RBI will be forced to hike interest rates for the seventh consecutive time in its April meeting, a move that will generate more headwinds for an already slowing economy. To be sure, analysts remain sceptical about the efficacy of interest rate hikes in dealing with a food price driven uptick in inflation.

Data released by the National Statistical Office (NSO) on February 13, put CPI growth at 6.5% in January . This is higher than the December, 2022 CPI value of 5.7%; the rise marks an end to the moderation in inflation numbers in November and December 2022.

The reversal in inflation trajectory is mainly a result of increase in food prices, with food inflation jumping from 4.2% in December 2022 to 6% in January 2023. While a 6% food inflation print is not unprecedented in itself, what makes the latest food inflation number more concerning is the fact that it is high despite an 11.7% contraction in vegetable prices – they have a share of 15% in the food basket of CPI – in January. A continuing surge in cereal inflation – at 16.1% it is dangerously close to all-time high values seen in the first half of 2013 – combined with a sharp increase in prices of milk and milk products (8.8%) and egg, fish and meat (6.3%) are the main reasons behind a rise in food inflation despite falling vegetable prices. Given the fact that vegetable prices are the most vulnerable to seasonal volatility, the latest food inflation print underlines structural rather than seasonal price pressures.

“A high cereal inflation directly feeds into milk and meat prices via the fodder and feed route”, said Himanshu, an associate professor of economics at Jawaharlal Nehru University who uses only one name. The government seems to have pre-empted the cereal price shock; HT reported on January 13 that it might extend the ban on export of wheat – wheat inflation stood at 25% in January 2023 – and non-premium rice beyond March . The surge in cereal inflation also comes in the wake of the government sharply cutting its food subsidy bill in the union budget and a prolonged high inflation scenario could force a review of that .

While a sharp rise in food prices has added to the inflation problem, core inflation data shows that non-food non-fuel prices continue to remain sticky at a higher than acceptable levels in the economy. Core inflation remained unchanged at 6.2% in January, making it the sixth consecutive month it has been above the 6% mark. “Headline inflation excluding vegetables has been rising well above the upper tolerance band and may remain elevated, especially with high core inflation pressures. Inflation, therefore, remains a major risk to the outlook”, the Monetary Policy Committee (MPC) of RBI had noted in its resolution released on February 8.

“Today’s inflation shocker led by food as well as consistently higher core inflation momentum has depicted we are far from the ‘durable disinflation’ process. This print will further strengthen RBI’s view that stickiness of core inflation could unmoor inflation expectations and lead to second-round effects in the medium term. The 4QFY23 (March 2023) inflation may now be possibly 50bps (basis points; one basis point is a hundredth of a percentage point) higher than RBI’s revised estimate and could also force the RBI to further tighten their stance ahead”, Madhavi Arora, Lead Economist, Emkay Global Financial Services said in a note. RBI has projected inflation in the March quarter at 5.7%.

Other experts were sceptical about the wisdom of administering more rate hikes to control inflation. “Interest rate hikes will not kill the demand for wheat and rice and additional hikes will only inflict more pain on an economy which is already losing momentum, as was seen in the latest Index of Industrial Production (IIP) data”, said Himanshu. “Future inflation trajectory, as of now, will depend more on climatic factors affecting the wheat and rice crops this year rather than the direction of monetary policy”.

That means it depends on the intensity and onset of summer, and the quantity and quality of the monsoon.

Get Current Updates on India News, Lok Sabha Election 2024 live, Infosys Q4 Results Live, Elections 2024, Election 2024 Date along with Latest News and Top Headlines from India and around the world.