Independence Day special: How to gain financial freedom with FD

You can be financially independent in the true sense only when you are free from market risks. Bajaj Finance Fixed Deposit gives you an opportunity to go risk-free by offering fixed returns on your investment.

As our country celebrates its 72nd Independence Day, let’s understand how freedom has evolved over the years. The freedom of speech, expression, religious, social or cultural norms is prerequisite, but the ability to live on your own terms and conditions comes essentially from financial freedom. Financial freedom enables you to be self-sufficient. The road to financial freedom is to earn enough to live on your own, pay for essentials and take control of your future. Your regular income may not always be enough to help you sustain yourself.

Making stable and mindful investments is hence an imperative aspect of financial freedom, which helps you grow your capital over time. However, swinging stock indices and changes in monetary policies have given sleepless nights to investors who seek stable growth of their capital. Thus, fixed-income investments are best suited for those seeking assured returns. Fixed deposit is one such preferred investment that can help you gain guaranteed returns.

Read on to know what makes FD the best investment avenue to ensure financial freedom.

1.Guaranteed returns

You can be financially independent in the true sense only when you are free from market risks. Bajaj Finance Fixed Deposit gives you an opportunity to go risk-free by offering fixed returns on your investment with no effect of market fluctuations.

Even as bank FD interest rates fluctuate with RBI’s policy announcements, Bajaj Finance FD rates are one of the highest in the market, even when the economic situation is volatile. Additionally, this FD has the highest stability ratings from CRISIL (FAAA/stable rating) and ICRA (MAAA/stable) rating.

2.Higher earnings than bank FDs

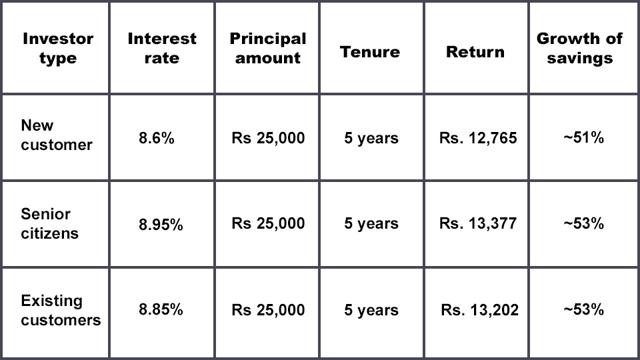

When you compare the FD rates in 2019 from different lenders, Bajaj Finance FD stands out with its lucrative interest rate of 8.60%, which can go up to 8.85% for existing customers, and up to 8.95% for senior citizens. The high FD interest rates offered by Bajaj Finance will help you accumulate and grow your savings.

As shown in the table below, you can achieve 51% growth of savings by investing in a 5-year Bajaj Finance FD.

3.Freedom to choose

Independence means the freedom to choose, and this instrument gives you the flexibility to choose investment terms as per your requirements.

-Flexible tenures- As per your financial needs and planning, you can choose a tenure between 12 and 60 months. Since financial independence has a lot to do with your liquidity and cash flow, flexibility in choosing tenure helps you ensure liquidity at all times.

-Laddering- Flexible tenures make it easy for you to ladder your investments. You can avail the benefit of multi-deposit facility, wherein you can invest in up to five FDs with a single cheque. Also, a continuous stream of FDs will help you with steady inflow of money at intervals, thereby helping you with liquidity. This lets you efficiently plan for all major life events.

-Interest payout frequency - You can choose to either receive the returns periodically or compounded at the end of the tenure depending on your needs. Interest payment mode can be set according to your preference- monthly, quarterly, yearly or at the time of maturity.

-Investment mode – Bajaj Finance also offers you the option to start investing with options like debit card, cheque or simply book your FD online.

If you are looking to build a corpus and save for the future, say, for your child’s higher education/marriage, an international vacation or for retirement, you can go for a cumulative fixed deposit.

If you expect your investments to take care of your daily expenses, you can choose a non-cumulative deposit, which gives regular interest payouts. This is a great investment option for senior citizens and pensioners, who seek a regular income from their savings.

4.Loan against FD facility

Financial exigencies come unannounced. An accident, hospitalization, unexpected business or material loss can threaten your stability. An instant online loan against FD will create a shield around you in times of crisis. You do not need to liquidate your savings.

5.No lengthy paperwork

Why get stuck in long queues and trapped in a maze of complex paperwork? Break free from the old ways and get a Bajaj Finance FD with a simple online application process. You can invest your hard-earned money easily from the comfort of your home.

You can open your Bajaj Finance FD account today with a minimal investment amount of Rs. 25,000. Invest today to enjoy one of the best FD rates and take one step closer to your financial independence.

Disclaimer: This content is distributed by Bajaj Finserv. No HT Group journalist is involved in the creation of this content.