How entrepreneurial dreams are lost when investors take over startups

In India, founders don’t seem to hang up their boots. They either put pressure from outside or, on certain occasions, return. This is because founders and managements don’t often think alike.

Fights, ousters and exits are likely to occur when the management of a company takes over from its founders. This is because founders and managements don’t often think alike.

In August 2014, Pravin Sinha, co-founder of Jabong, the online apparel company recently bought by Flipkart-owned Myntra, decided to move on. That happened after Jabong’s largest investor, Rocket Internet, decided to merge the company with Global Fashion Group, its clutch of online apparel companies spread across the world.

Jabong was a success story in Indian e-commerce. Sinha was respected too. However, while he decided to stay on through the transition, its other founders – Arun Chandra Mohan and Lakshmi Potluri – left.

“That was not planned,” said Sinha, who believes conflicts begin once a company is taken over by a management put in place by investors or its board.

Infosys, the 36-year-old poster boy of Indian IT, was caught in turmoil when founder NR Narayana Murthy claimed that the company suffered from governance issues, and raised questions about the high severance package provided to ex-chief financial officer Rajiv Bansal and CEO Vishal Sikka’s compensation.

In India, founders don’t seem to hang up their boots. They either put pressure from outside or, on certain occasions, return. Though the Tata Group is not a start-up and Ratan Tata is not its founder, the recent ouster of former chairman Cyrus Mistry goes to show that even family-run businesses want company managements to toe their line of thought.

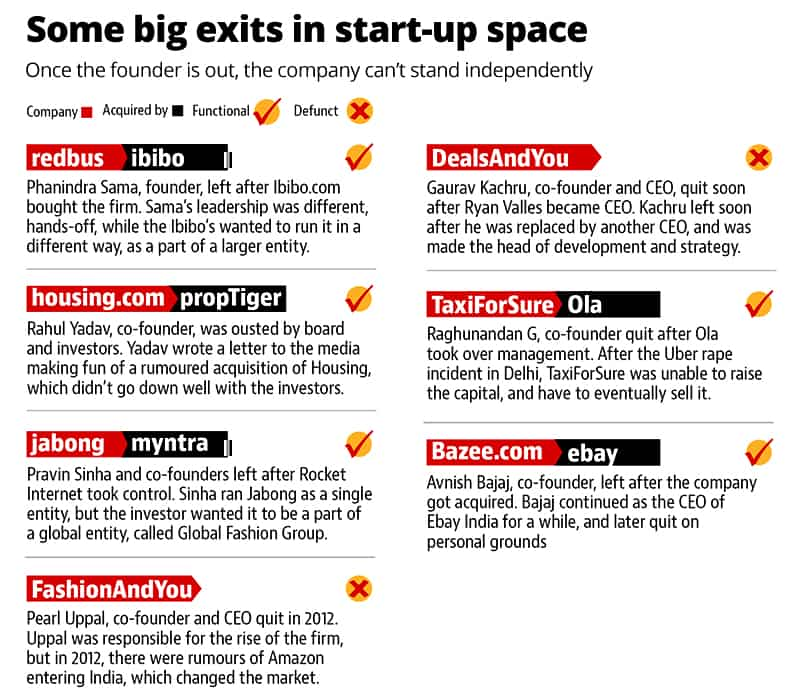

As Sinha knew the fate that awaited him, he told Rocket Internet that he would not hang around for long. “Had I not told them, the same thing (like Infosys or Tata) would have happened to me,” he said. Jabong is just one of the many examples of founders leaving the company once the management takes over. Phanindra Sama walked out after selling redBus to Ibibo.com, Rahul Yadav was ousted from Housing.com, Raghunandan G quit TaxiForSure after Ola acquired it, and Pearl Uppal made a discreet exit from FashionAndYou.

In most cases, the board is run by investors who pump in large amounts of money to fund initial growth and compensate for losses. “Once they hold beyond 35% to 40% stake in the company, investors start pressing for approvals and other decision-making responsibilities,” said Sanchit Vir Gogia, CEO and chief analyst of Greyhound Research.

After Sama sold redBus, he did not imagine that most of the senior members of his team would quit within 10 days – while he was on vacation. By then, the Naspers-run Ibibo had taken over the redBus management run by CEO Ashish Kashyap. His working style was markedly different from Sama’s hands-off mode of functioning.

“When skills are not complimentary, investors are forced to choose a professional CEO… Investors believe that the focus should be on skills and processes… That is the reason why four out of five start-up founders move on,” said Rahul Guha, partner and director at the US-headquartered Boston Consulting Group. Grapevine has it that Tiger Global Management, the largest investor in Flipkart, calls the shots at the e-commerce firm. Kalyan Krishnamurthy, a former Tiger employee, is Flipkart’s new CEO. Co-founders Binny and Sachin Bansal have moved away from the company’s day-to-day operations. Rahul Yadav, once the celebrated founder of online real estate marketplace Housing.com, was asked to leave because his behaviour was reportedly found detrimental to the company. Yadav was young, quirky and loved to play pranks – something that didn’t resonate with the corporate culture of Softbank, the firm’s largest investor.

Getting on a call with K Vaitheeswaran, founder of the now-defunct Indiaplaza, helps shed some light on the issue. The country’s first e-commerce website, it succumbed in the discount battle while rivals such as Flipkart and Snapdeal accumulated huge losses.

“When investors put a lot of money into a firm, they come with a pre-conceived mindset… An investor should never run a company,” said Vaitheeswaran. The reason, he says, is simple. While a company is nothing short of a child for its founder, the investor looks at it as just another entity to churn money.

“It’s bad news to have investors running a company. That means the investor does not have confidence in the founders anymore, and they want to safeguard their own interests,” said Vaitheeswaran. However, he refused to make any specific observations on Flipkart.

The worrisome fact, however, is that most startups are funded. With every round of funding, the stake held by the founders and the founding team goes down – sometimes leaving them with just a single-digit share while investors possess the majority. For instance, Tiger Global is the single-largest shareholder in Flipkart – with 30% to 33% of the company. It has pumped about $1 billion into the venture.

Back at Infosys, Murthy could never have ousted Sikka – even with his cult status – as all the founders put together hold just 12.5% of its stock. In the case of Tata, Mistry’s ouster was easier. Ratan Tata is the chairman of Tata Trusts, which holds 66% of Tata Sons, the holding company.

Sinha said investors cannot call the shots if the founders have controlling stake in a company. “But as the stake goes down, the decision-making capacity of founders comes down significantly. Even if the founder stays – it is usually in a non-executive role (as was the case with Flipkart’s Bansals),” said Sinha.

Infosys is perhaps the most successful start-up India has witnessed, with global operations listed on Nasdaq. It has always been known for its transparency, standing tall on a reputation built by its founders. However, most start-ups don’t have that. “At that juncture, a lot depends on the relationship shared by the CEO or the founders with investors,” said Gogia.

Once upon a time, companies such as TaxiForSure, Housing and Indiaplaza were icons of India’s startup culture – hailed by investors and the public alike. Today, they have either been swallowed up by bigger fish in the corporate arena or forced to wrap up their operations and call it a day.

Stay informed on Business News along with Gold Rates Today, India News and other related updates on Hindustan Times Website and APPs