Indian economy in 2018: Dampened sentiments need a cheer-up tablet

India is grappling with the mismatch between economic fundamentals and business sentiments, which appeared to have taken a hit in the aftermath of the demonetisation exercise and the implementation of GST. The government’s perceived differences with the central bank have not helped matters.

The Narendra Modi government entered the last year of its tenure in 2018. If someone was to look at headline economic indicators from 2014 onwards, the track record would appear impressive. Gross Domestic Product (GDP) growth has been above the 7% mark most of the time, and was achieved without any major breach of inflation and fiscal deficit targets.

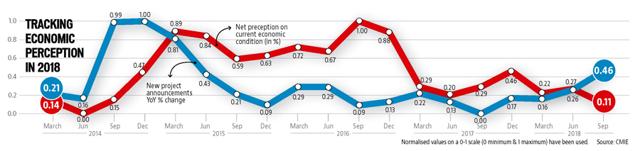

These numbers would suggest widespread economic satisfaction vis-à-vis the government’s functioning. However, an HT analysis shows that the economy has seen better days under the present government in terms of both investor and consumer sentiment than the situation in 2018. The analysis has used annual growth in value of new investment announcements from the Centre for Monitoring Indian Economy (CMIE) database to track investor sentiment. Net perception of the current economic situation from the Reserve Bank of India’s Consumer Confidence Indices has been taken as a measure of consumer confidence. Both these values peaked after the current government assumed office in May 2014.

New investment announcements started declining soon after due to reduced capacity utilisation levels and the bad loan problem in the banking sector. While the cycle seems to have reversed from end of 2017, growth in new investments in the last year of the Modi government is nowhere close to what it was in its first year. Consumer confidence levels, which were resilient until the November 2016 invalidation of high-value banknotes, have tanked 2017 onwards. What is worth underlining is the fact that consumer sentiment has not recovered in 2018, even though there was a revival in terms of GDP growth as disruptions caused by demonetisation and the introduction of the Goods and Services Tax subsided. These statistics highlight the challenge of policy-making.

A major slippage on the fiscal or inflationary front can destabilise the economy and spook foreign investors, which could trigger a crisis on the external front. However, macroeconomic stability is no guarantee of widespread economic well-being. In fact, the two could have a contradictory relationship. Lower inflation (read decline in food prices) has been an important source of rural distress in recent times.

It is tempting to use these trends to predict the outcome of the 2019 elections. Even more important, however, is the need to tackle this mismatch between economic fundamentals and sentiments at the policy level.

Stay informed on Business News, TCS Q4 Results Live along with Gold Rates Today, India News and other related updates on Hindustan Times Website and APPs