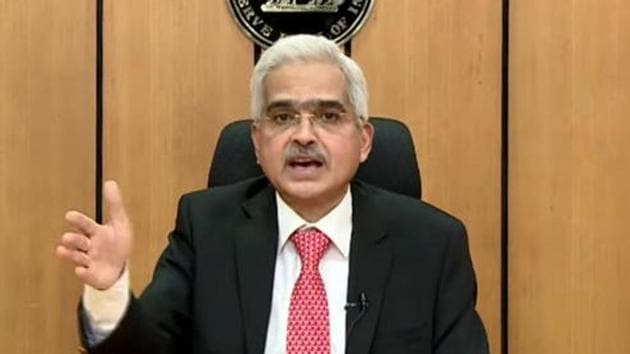

RBI governor Shaktikanta Das to address media shortly

The government is slated to sell 200 billion rupees ($2.6 billion) of bonds.

When India kicked off its record-borrowing plan last week, traders were betting that the central bank would step in quickly to ease the debt burden. Governor Shaktikanta Das will make an unscheduled address on Friday just as another auction looms.

The government is slated to sell 200 billion rupees ($2.6 billion) of bonds. Its first auction of 190 billion rupees was unexpectedly fully subscribed as investors bought on expectations that the Reserve Bank of India would purchase more debt in the secondary market to cap rising yields.

“Every successive auction will see less demand in a market that’s completely dislocated” if the RBI doesn’t step in, Vijay Sharma, executive vice president for fixed-income at PNB Gilts Ltd. said before the RBI announcement. “The sell-off in bonds can get much uglier.”

India’s predicament is mirrored in other Asian markets, as governments compete for funding to combat a coronavirus-driven slowdown. While central banks in Australia and New Zealand have embarked on massive bond purchases, capping borrowing costs, the RBI has largely refrained from the measures.

As a result, India’s benchmark 10-year bond yield has climbed 30 basis points so far in April, set for its biggest monthly rise in two years.

Modi’s Debt Plans

The RBI didn’t disclose details of the governor’s address, which will be broadcast on YouTube at 10 a.m. local time.

The government is selling 450 billion rupees of debt, including Treasury bills, every week for the first half of the fiscal year to help fund Prime Minister Narendra Modi’s record borrowing plan of 4.88 trillion rupees during this period. The weekly debt issuance is about 20% higher than a year ago.

“Market participants are heavily banking on the RBI for their rescue,” said Dhawal Dalal, chief investment officer for fixed income at Mumbai-based Edelweiss Asset Management Ltd. “Any miscalculation by the RBI could result in a sudden increase in yields.”

Last week, the government had to pay underwriters almost 50 times more in fees for its first bond sale of the fiscal year, underscoring how nervous primary dealers were. The RBI executed a 75 basis points emergency rate cut last month, and also pledged to provide $50 billion of liquidity.

Attractive Yields

However, some traders are of the view that higher yields may attract some demand. The benchmark 10-year yield rose one basis point on Thursday to 6.44%. It had risen to 6.51% on April 9, the highest since February.

“After the recent sell-off, banks may be seeing a good value in the current level of yields,” said Debendra Dash, a Mumbai-based fixed-income trader at AU Small Finance Bank in Mumbai. “The 10-year yields are expected to stay around the current levels, and any sustainable rally will be guided by the RBI’s support.”

Stay informed on Business News, TCS Q4 Results Live along with Gold Rates Today, India News and other related updates on Hindustan Times Website and APPs