2 yrs since Make in India launch, only smartphones thrive in manufacturing sector

Narendra Modi promised a job revolution through manufacturing but two years later, little has flown into the programme’s centrepiece, apart from mobiles and autos.

Flextronics, the Singapore-headquartered electronic manufacturer already has a capacity to make 10 million mobile phones in its Chennai facility. Spread over a 100-acre campus the company makes phones for Lenovo, Huawei and Motorola.

But, at Flextronics, mobile phones are only being assembled (components are imported), and the situation is same for each and every mobile manufacturing company in the country.

Still it is a huge change considering that just three years ago, most of the smartphones sold in India were imported. To put that in context, the rise of mobile phone assembly is at the heart of Prime Minister Narendra Modi’s Make in India.

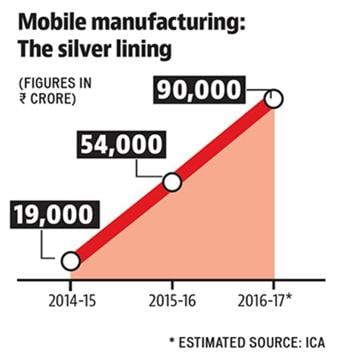

The value of mobile phones assembled in India has increased 373% in the last two years, from Rs 19,000 crore in 2014-15 to more than Rs 90,000 crore in 2016-17. About 40 mobile phone making plants have started since Modi announced Make in India in September 2014. These plants manufacture 20 million phones every month.

“India has similarities with China – the consumption in India, and the rise of the middle class,” said Jeff Reece, president, networking solutions at Flextronics.

It has been over two years since the launch of Make in India and government hasn’t tired of relaying its success story. Some of the biggest announcements of manufacturing in India has been in the electronics space, such as Foxconn, Huawei, Oppo, LeEco etc. Without these and the buzz around India as the favoured destination for mobile phone manufacturers, many suspect, the Make in India pitch would be dull.

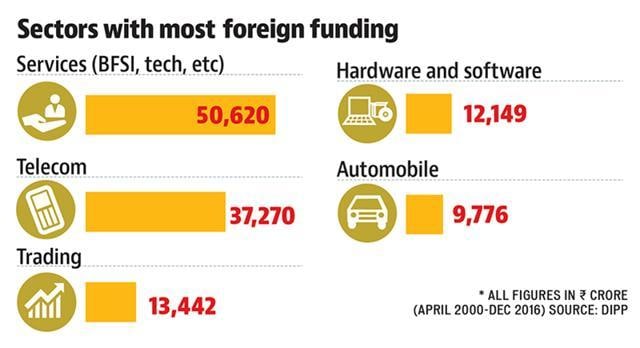

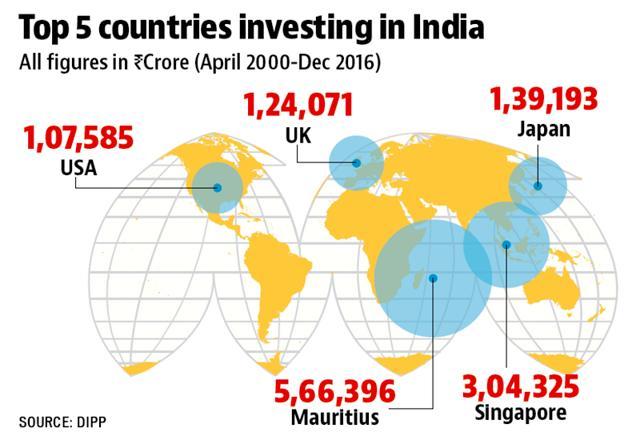

A closer look at the oft repeated ‘record’ foreign direct investment data shows that most of it has flown into sectors such as services, software and trading. The over 48% increase in foreign direct investment into India, since the campaign was launched, has not significantly flown into its centrepiece, the manufacturing sector. The exceptions are automobiles and electronics, with the latter becoming the crowning glory for the government.

“FDI is driven by business environment, so it will naturally flow into the services sector which has a cleaner regulatory structure. Land acquisition and environment laws are the biggest hurdles for FDI to come into manufacturing. The problem is compounded by our federal structure as it means different states will have different laws,” said Madan Sabnavis, chief economist, CARE Ratings.

In the calendar year 2016, foreign direct investment flowing into India rose 18% over the previous year. The favourites being the services sector that attracted $7.5 billion followed by telecommunications which attracted $5.5 billion.

Many experts say that the popularity of India as the electronic manufacturing destination is due to the differential duty offered by the country. If a handset-manufacturer assembles phones locally, then it pays a 1% duty, instead of the 12.5% on a phone that is imported. Along with this the Make in India programme also provides modified special incentive package scheme (MSIPS) and zero-duty on import of all components except adapters, batteries and headsets, to handset makers.

Job Creation

The genesis of the Make in India campaign was job creation and developing a skilled workforce, the stated electoral promises for the Modi government. For India to replicate the manufacturing-led model that created 64 million jobs in China between 2011 and 2016, several areas need focus.

“Infrastructure is a challenge. Ease of doing business across states needs to be seamless. A component supplier base needs to come up in India, and has to be localized. There has to be a business case behind it,” said Reece of Flextronics.

Mobile manufacturing units generated 38,300 new jobs in last two years with Taiwanese electronics company Foxconn being the top employer with a workforce of 8,000. This sector’s contribution to the GDP likely to be 8.2% by 2020 with a potential to add 8 lakh jobs, so special attention should be given.

To scale up this employment potential, as Reece pointed out promotion of local manufacturing of mobile components is key.

Currently, the handset makers in India import semi-knocked down (SKD) units which include the circuit board and the microchip set of the mobile which account for more than half the value of the phones. Most of the other components, including the display screen, wi-fi antenna, mic are also imported and then soldered together in India. To this the ‘Made in India’ components of battery, charger, USB cable and earphones are added and then the finished product is put into the box along with the accessories and the instruction manual.

It will take time for the entire process to be localised. Imports have cost advantages given that India lacks world-class component makers. And here lies an opportunity for the government.

“Once the demand picks up, and the overall eco-system develops, component manufacturing will follow,” hoped P. Sanjeev, India business head for Huawei & Honor consumer business.

Local component manufacturing is key to boost a sector. As NITI Aayog points out in its vision document, the time has come for India to identify sectors and create world class industries in them.

India can take a leaf out of China’s book. To create scale and develop home-grown brands, the Chinese government has ensured local manufacturing of components, be it for mobile phones, automobiles or even solar power plants.

But till the components eco-system develops in India, the likes of Apple Inc will continue to clamour for 15-year tax holidays to set up shop in the country.

Stay informed on Business News along with Gold Rates Today, India News and other related updates on Hindustan Times Website and APPs