Rupee weakens to 60 per dollar again, RBI bats for stability

RBI governor Duvvuri Subbarao, possibly presenting his last credit policy before he demits office in September, put the focus firmly on managing the rupee’s slide, seen as a greater worry than spurring investment. HT reports.

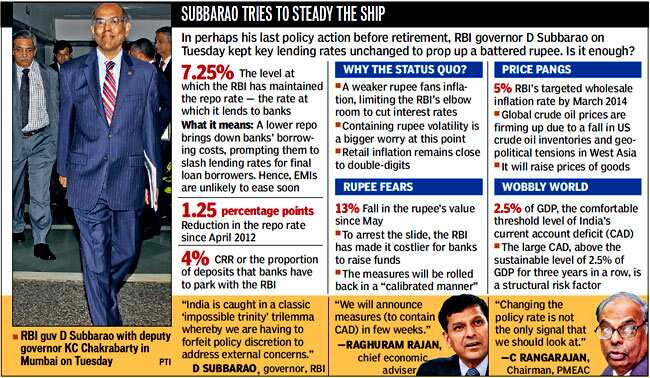

Reserve Bank of India (RBI) governor Duvvuri Subbarao, possibly presenting his last credit policy before he demits office in September, put the focus firmly on managing the rupee’s slide, seen as a greater worry than spurring investment despite a crippling industrial slowdown.

Expectedly, he kept key lending rates unchanged, dashing hopes of a fall in EMIs for millions, and virtually ruled out a sovereign bond issue in the immediate future.

Amid widespread speculation over his likely successor as India’s central bank governor after his term ends on September 4, Subbarao argued why containing the rupee was a far higher priority amid looming threat of dollar outflows once the US starts unwinding its stimulus programme.

In recent weeks, the central bank has taken a string of steps to curb speculation in the foreign exchange market and to prop up the rupee, which had hit a record of 61.21 to a dollar recently.

On Tuesday, the rupee slid again, losing 106 points to close at 60.47 to the dollar — its biggest single day fall in a month — as the RBI refrained from a timeline to roll back liquidity-tightening measures.

“I want to say that the Reserve Bank is sensitive to the short-term costs of tight liquidity measures on economic activity,” Subbarao said on Tuesday. “And we are as anxious as everyone else to roll this back. But getting locked into a timeframe is both infeasible and inadvisable.”

Chief economic adviser Raghuram Rajan said the government is likely to announce new measures in the coming weeks to contain the rupee’s fall and rein in the current account deficit (CAD), the difference between dollar inflows and outflows.

All eyes will now be on finance minister P Chidambaram, who is scheduled to address a press conference on Wednesday.

“In the Reserve Bank’s view the sovereign bond issue — we have reservations about that. We have done a cost-benefit analysis of the sovereign bond issue,” Subbarao said. “The cost of a sovereign bond issue, especially in the current juncture, outweigh the benefits.”

Subbarao retained the repo rate, the rate at which it lends to banks, at 7.25%.

He also retained the cash reserve ratio — the proportion of funds banks have to park with the RBI — at 4%.

The RBI’s targeted comfortable level of inflation is 5%, to be attained by March 2014.

“The large current account deficit, well above the sustainable level of 2.5 % of GDP for three years in a row, is a formidable structural risk factor. It has brought the external payments situation under increased stress, reflecting rising external indebtedness and the attendant burden of servicing of external liabilities,” Subbarao said.

The government is expected to announce more reforms in the next two months.

Stay informed on Business News along with Gold Rates Today, India News and other related updates on Hindustan Times Website and APPs