VVIP chopper case: In fresh raid, I-T finds bloated invoices for $6mn

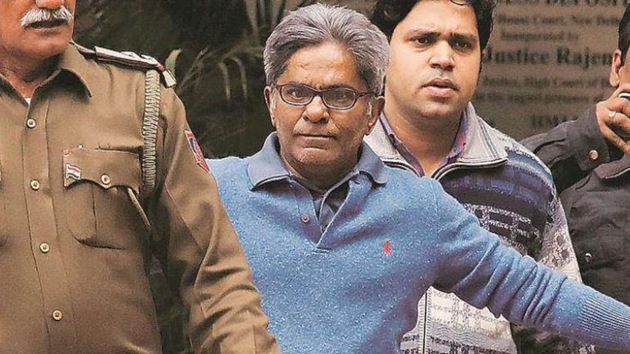

This is the second major search and seizure operations conducted recently against people having links with Dubai-based operator Saxena, who was extradited in India in January this year, the officials said.

Hyderabad-based Alphageo (India) Ltd is found to be involved in a large scale “over-invoicing of imports” through VVIP chopper scam accused Rajiv Saxena in a recent search operation conducted by the income-tax department, two officials with direct knowledge of the matter said requesting anonymity.

This is the second major search and seizure operations conducted recently against people having links with Dubai-based operator Saxena, who was extradited in India in January this year, the officials said.

The department on Tuesday “provisionally” attached shares worth ₹254 crore related to companies of Ratul Puri, the nephew of Madhya Pradesh chief minister Kamal Nath, after it discovered that the transaction involving the non-cumulative compulsory convertible preference shares were made with the help of Saxena through shell companies, officials said.

Queries sent to the Central Board of Direct Taxes (CBDT) and Alphageo (India) Ltd did not elicit any response. Alphageo (India) Ltd’s promoter Dinesh Alla could not be contacted. A spokesman for Puri said, “As the matter is under sub judice, it would be inappropriate to comment on the matter. What we can confirm is that the company has followed all the guidelines of governance. Right from commissioning India first 5 MW and the then largest solar farm in Asia, the company has many distinction to it’s credit. All these allegations are speculative and unfortunate.”

In a statement issued on Wednesday, the I-T department said the search action took place on July 24, 2019, on a “Hyderabad based group engaged in the business of conducting seismic data analysis”. The statement did not, however, disclose the name of the company.

“The surplus funds thus generated amounting to USD 6 million were parked in Dubai based accounts of the said operator,” it said.

During the search, incriminating evidences including e-mail and mobile conversations were found between the main director of the searched company and the Dubai-based operator, pertaining to over-invoicing of imports, the statement said.

“When confronted, the persons concerned admitted to over-invoicing,” it said. The investigation further led to detection of at least four additional undisclosed foreign bank accounts in UBS bank Switzerland, OCBC Bank Singapore, Citizens Bank, USA and Bank of Nevis International, St Kitts.

The department also discovered three undisclosed companies of the Hyderabad-based promoter in tax havens such as British Virgin Islands, Island of Nevis and Singapore.

Unexplained cash of ₹45 lakh found during the search has been seized besides jewellery worth ₹3.1 crore, which is in the process of being verified, the statement said.

The earlier move of the department to attach shares issued to Puri’s group companies was conducted by its Benami Prohibition Unit, which acted on the basis of credible information that the shares were received through a maze of shell companies as foreign direct investment, officials said.

According to officials, the action was initiated under the Prohibition of Benami Property Transactions Act because the ₹254 crore investment was generated through over-invoicing of imports of solar panels by one of the group companies of Puri and the transactions took place through overseas shell companies.

Puri is already under scanner of agencies such as I-T department and the Enforcement Directorate on charges of tax evasion and money laundering. The agencies had conducted raids on Puri’s companies in April this year and found several evidences of tax evasion worth ₹1,350 crore.