Record GST collections expected in March, set to hit ₹1.30 lakh crore

The revenue in March may cross the record Rs.1,19,875 crore collected in January by at least Rs.10,000 crore.

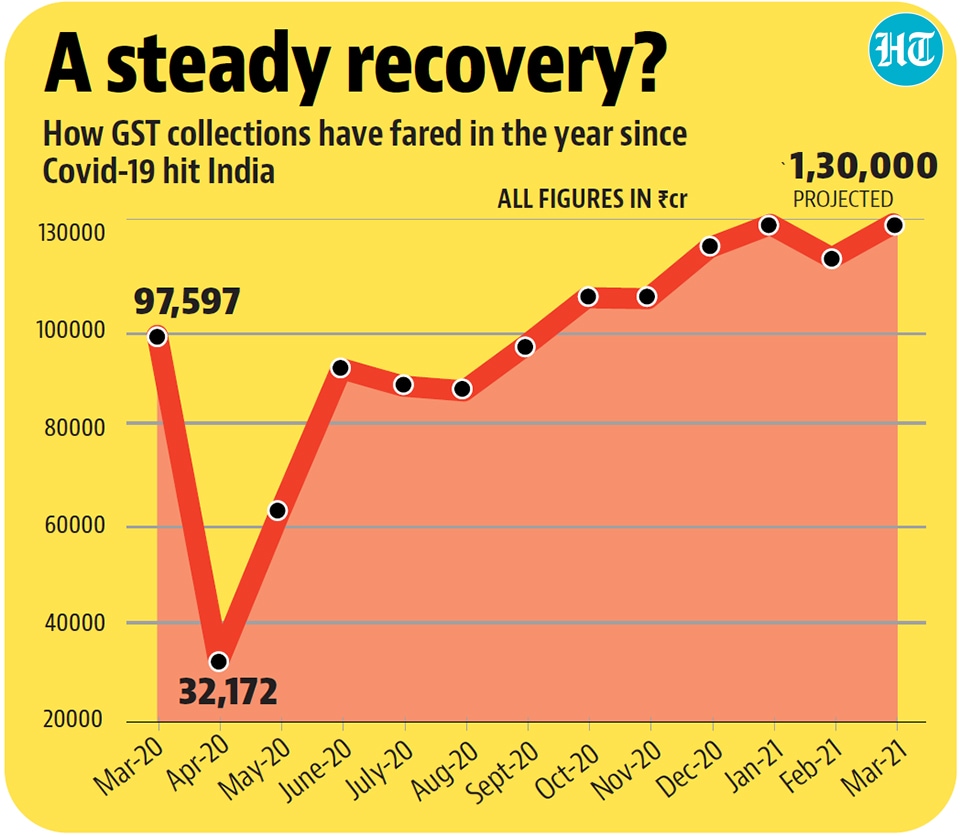

India’s Goods and Services Tax (GST) collection in March 2021 is expected to touch a record high of around Rs.1.30 lakh crore on the backdrop of a rapid economic recovery from the Covid-19 pandemic and a hard lockdown necessitated by it, two people aware of the development said.

The people, who asked not to be named, attributed the enhanced collections also to stricter compliance through e-invoicing, which had made it difficult to evade tax.

The revenue in March may cross the record Rs.1,19,875 crore collected in January by at least Rs.10,000 crore, the people said.

The recovery in GST collections reflects the larger revival in the economy. India’s economy shrank by 24.4% in the three months ended June 30 and 7.3% in the three months ended October, before entering growth territory and expanding by 0.4% in the three months ended December 31. The government has estimated the entire year’s GDP contraction at 8%, although many experts expect it to do better.

After remaining in contraction mode for six months in a row, since March 2020 — India imposed a 68-day-long hard lockdown in late March — GST collections started growing from September 2020. GST collections, which plunged to an all-time low at Rs.32,172 crore in April 2020, touched a record Rs.1,19,875 crore in January. The latest GST collection figure was Rs.1,13,143 crore for February 2021, a 7.3% year-on-year growth.

Pratik Jain, partner and leader, Indirect Tax, PwC India, said: “GST collections are on an upsurge in last four-five months even without raising GST rates. This is because of tightening of compliances, increased rigours in audit /investigation and leveraging technology to widen the tax base. Besides, economy is recovering fast and that would also be reflected in the March collections.”

The compulsory e-invoicing system that started in January this year has plugged business-to-business (B2B) tax evasion to a great extent as transactions above Rs.100 crore are mostly B2B, where correct invoicing is insisted upon by both buyers and sellers to avail input tax credits and avoid penalties, one of the two people cited above said.

“Thus, increased use of technology has helped to ease compliance burden on the one hand and raised fear among unscrupulous elements on the other,” he added.

The government made e-invoicing mandatory for businesses with an annual turnover of Rs.100 crore and above from January 1. The idea is to progressively make it compulsory for all.

The second person added that no significant B2B transaction is now possible below the GST radar as e-invoices require QR codes, which are generated from the GST Network (GSTN). “GSTN has an instant record of all transactions,” he added.

“There are two more reasons for the optimism that GST collections could cross Rs.1.30 lakh crore in March. One is the fiscal year closing on March 31, and the other is a temporary freeze on refunds.”

The tax department usually goes slow on refunds towards the end of the financial year to make it easier to close books, this person explained.

The two people said the higher GST collection in March is expected despite February being a smaller month. Official GST collection data comes with a lag because the last date for paying GST is the 20th day of the following month. Therefore, the March GST collection figure actually reflects business activities in February.

MS Mani, partner at Deloitte India, said: “Despite the fewer number of working days in February and although the services sector continues to operate with restrictions, the GST collections for February [officially March figures] are expected to be robust due to the continued growth in GDP [gross domestic product] and the anti-evasion drive undertaken by the authorities.”

Get Current Updates on India News, Lok Sabha election 2024 live, Election 2024 along with Latest News and Top Headlines from India and around the world.