Making that home loan switch

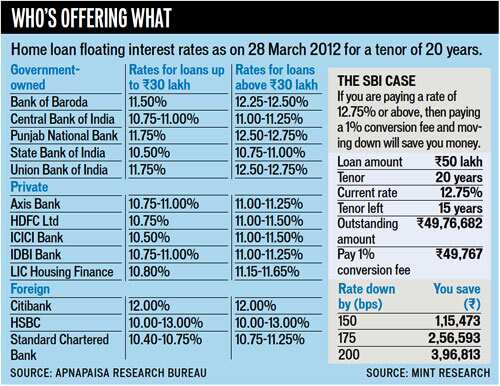

Last week, the country’s largest bank, State Bank of India (SBI), decided to reduce the interest rate burden of existing home loan borrowers by allowing them to switch to a lower interest rate. Bindisha Sarang writes. Who's offering what

Last week, the country’s largest bank, State Bank of India (SBI), decided to reduce the interest rate burden of existing home loan borrowers by allowing them to switch to a lower interest rate.

The new rate is in the range of 10.75-11.25% per annum, depending upon the loan tenor. However, you need to pay a fee of 1% for the switch.

The move was also likely to benefit those who took teaser loans, said experts. “Those who took the teaser loan will see their loan shift from around 8% fixed in 2009 to around 12% floating at current rates,” said Adhil Shetty, CEO, Bankbazaar.com. “Many borrowers may look to shift lenders offering better deals. This (SBI) move is to prevent the exodus of teaser loan borrowers."

SBI borrower or not, if you are still on the BPLR regime or are set to float after enjoying the fixed rate for the initial few years, switching your loan at this point may make sense with many banks offering competitive rates.

Why does switching make sense now?

There is a good possibility that the rate of interest you pay as of now is around 12.75% per annum, plus minus 50-75 bps.

“If you are currently paying a rate of interest above 10.75% per annum, it absolutely makes sense to switch the loan to another lender, irrespective of the loan amount,” said Harsh Roongta, CEO, Apnapaisa.com, a loan portal. “Especially now when lenders don’t charge a prepayment fee while switching a floating rate loan. If you are getting better rates, there is no point continuing at higher rates. There are (BPLR) borrowers who are still paying above 14% per annum.” Competitive rates: Many banks are offering competitive rates as of now.

“The rates offered across banking is in the range of 10.50-10.75% for loans below Rs 30 lakh and 10.75-11.25% for loans above Rs 30 lakh,” said Vipul Patel, director, Home Loan Advisors.

Last week, IDBI Bank reduced its home loan interest rates by 75 bps, with new rates being in the range of 10.75-11.50% per annum. Canara Bank also reduced its rates for new borrowers by 175 bps recently.

SBI offer: While it’s best to shift to a lender offering a lower rate, if you want to continue with the bank, it’s better to take the offer even after paying the conversion fee (see graph). If you want to continue with your lender as a borrower, see what rate you can negotiate also try and negotiate for a lower conversion fee if your lender charges any.

What should you do?

Look at the cost: While switching, remember to take into account the total cost of the old loan and the new loan. “While switching the loan take into account the cost of switching,” said Shetty. “Interest rate is an important parametre. Also the processing charges of the new lender is to be taken into account.” There are lenders who charge a fixed processing fee of Rs 5,000-10,000 and switching may work in such cases.

The existing lender would not want to let go of a good borrower, while the new lender would be open to negotiate the fees. “If you’ve been a good borrower, there is a good possibility that the new lender could waive the processing fee of your loan totally, and the switching would then be at zero cost,” said Roongta.

Don’t wait for rate cuts: While everyone expects rates to start falling soon, no one can tell exactly when that would happen for sure. “Why should you wait for rates to fall and pay more till then,” asked Roongta. “Even if you switch now and rates fall later, you will get the advantage of the fallen rate later.” To stick to your existing lender or ditch it for a new is your call because you will need to do detailed paperwork once again. If you do decide to change, we recommend shop around, negotiate hard on rates and fees before making that switch.

Get Current Updates on India News, Lok Sabha election 2024 live, Election 2024 along with Latest News and Top Headlines from India and around the world.